A while back, I learned that a family member was using a debit card for all of their purchases. After helping them get a points-generating credit card, they earn 2% cash back on all their purchases and are protected from fraud. Unless you can’t qualify for a credit card, only use debit cards for ATM withdrawals, never for purchases. Credit cards provide more protection, liquidity, and benefits than debit cards, so long as you don’t carry a credit card balance. Share this post with a child, parent, or friend who might be using a debit card for some or all of their purchases.

30% of Consumer Purchases are Made with Debit Cards

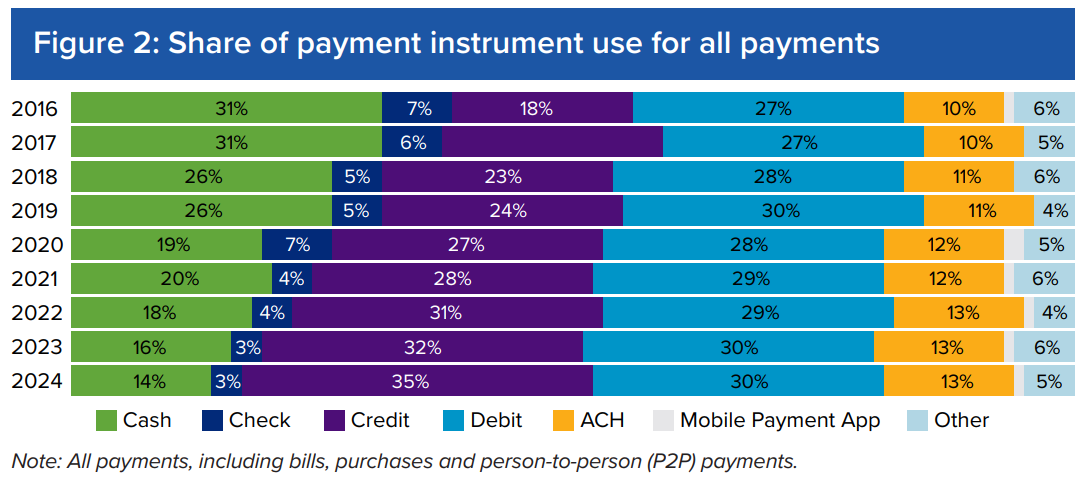

According to the Federal Reserve bank, consumer payments by “swipe,” continue to increase, with 65% of all consumer purchases, including online and bill payment, made with a credit or debit card in 2024.Cash and check continue to decline, who pays with a check anymore?

Credit card use for payments has doubled since 2016, but troubling for me is that debit card use has remained steady. This is troubling because 30% of payments are still made with debit cards, but nearly all consumers should never use a debit card for any purpose other than getting cash from an ATM.

Debit cards are bad for consumers because they don’t do much to protect you from fraud, they can keep your cash on hold for days, they don’t offer any benefits, and you miss out on reward points or cash. To be fair, some consumers can’t qualify for credit cards, and for them, debit cards are a good choice. However, 85% of US consumers have a debit card, and 72% have a credit card, so most debit card users have a credit card; they are just choosing to use their debit card.

Credit Cards Provide More Protection from Fraud

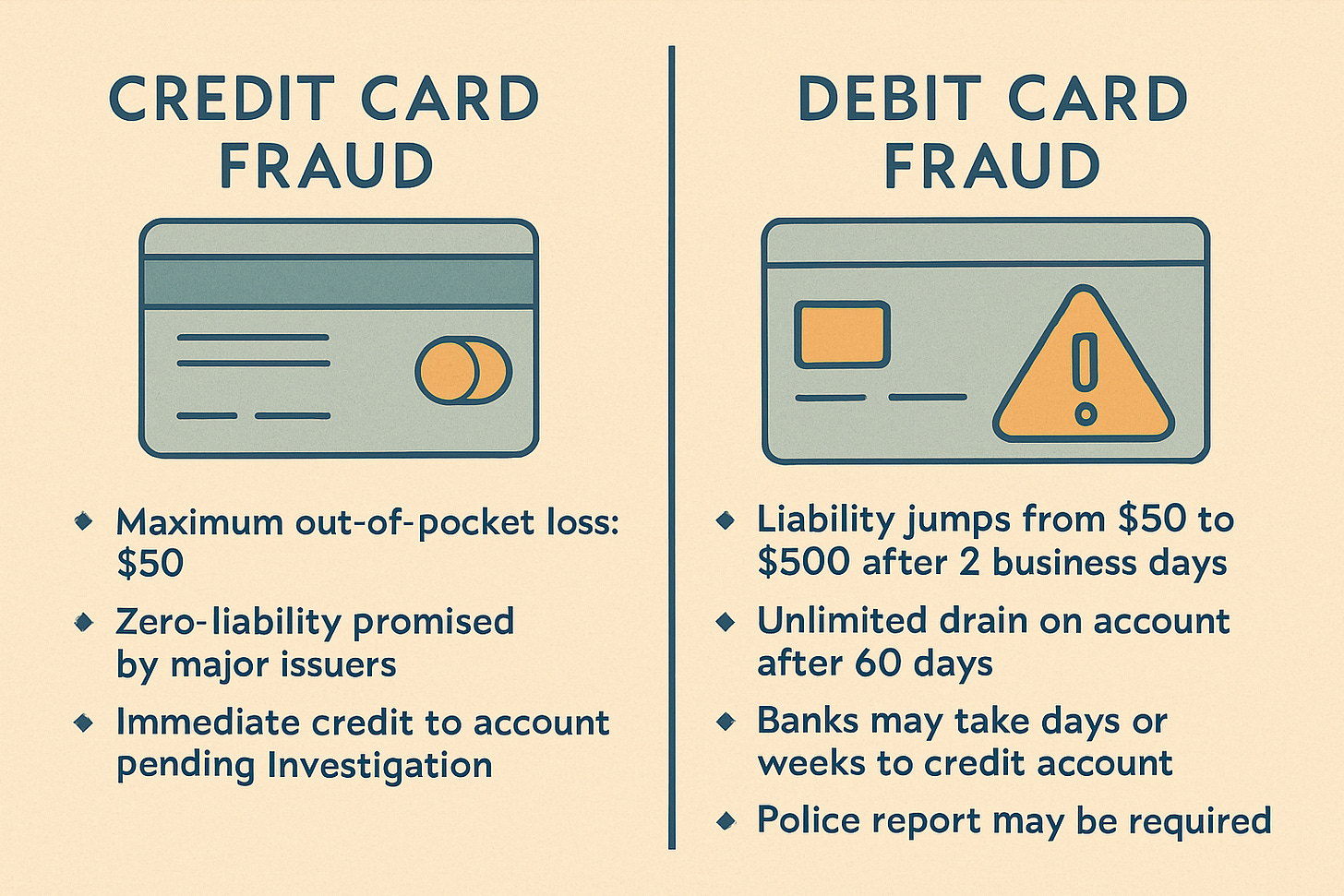

Card issuers' systems for detecting card fraud are getting better, but still, about 7% of US consumers experienced payment card fraud in 2024. Swipe a credit card and you’re spending the bank’s money, swipe a debit card and spend your own. Under the Fair Credit Billing Act, your maximum out-of-pocket loss on a fraudulent credit-card charge is $50, and every major issuer promises “zero liability” in practice. Your bank will immediately credit your account for most credit card fraud complaints.

The stakes are much higher with a debit card. The Electronic Fund Transfer Act gives you only two business days to flag a stolen card before your liability jumps from $50 to $500, and after 60 days, the drain on your account can be unlimited. Banks can take days or weeks to credit your debit card after fraud, and in some cases, may require a police report.

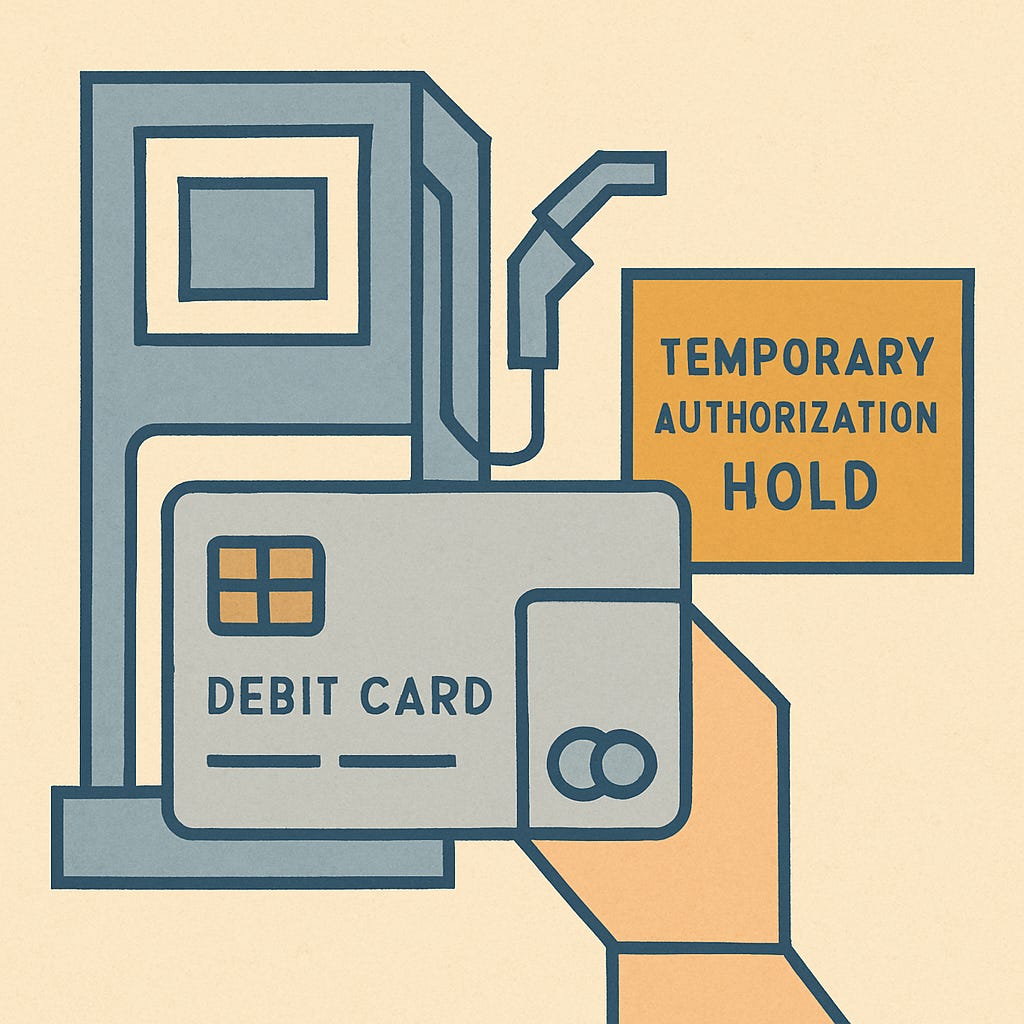

Debit Card Holds Can Tie Up Cash for Days at a Time

Swipe your debit card at the gas pump, and the machine will place a “pre-auth” hold, often $100 or more, on your checking account. That money doesn’t leave your account, but it’s frozen for days, especially if you fill up late on a Friday and the release window collides with a bank holiday. Hotels raise the stakes with debit cards. Hand over a debit card at check-in, and the front desk typically locks up an extra $50–$200 for incidentals, and Visa even permits those holds to remain for as long as 30 days, though a week is more common. While these holds are in place, you can’t access your money in your checking account.

Credit Cards Offer Benefits, Reward Points, and Cash Back

Unlike debit cards, credit cards offer rewards and benefits. For those with great credit, travel-oriented cards like Chase Sapphire Preferred provide from 1 to 3 points (worth an average of 1.5 cents each) for purchases. The Chase Sapphire Preferred also offers primary rental car coverage, so you don’t have to submit a rental car accident claim on your own insurance. Even consumers with “fair” credit can qualify for cards like the Citi Double Cash, a no-annual-fee card that pays 2% cash back on all purchases.

Don’t Ever Carry a Credit Card Balance

It's crucial to avoid carrying a balance on your credit card, as interest charges quickly accumulate. Nearly half (48%) of American credit cardholders are carrying a balance from month to month. This collective debt is staggering, with Americans holding a total credit card balance of $1.2 trillion. A simple way to sidestep interest charges is to set up automatic credit card payments for the full statement balance each month. This strategy effectively makes your credit card like a debit card in that you only spend what you have.

And, Don’t Use Debit Cards for Purchases

While debit cards certainly have their place for ATM cash withdrawals, they fall short for most other transactions when compared to credit cards. By opting for a credit card for your everyday purchases and, crucially, committing to paying the balance in full each month, you gain significantly stronger fraud protection, avoid multi-day holds on your cash, and open yourself up to valuable benefits, from travel points to cash back.

Peace through understanding.

Great advice Ben.

If you have a credit card and have the discipline to pay off the monthly balance, use credit cards over debit cards every time. The protections against fraud and card number theft are comprehensive, and you are not risking your money in your checking account to theft or holds.

###

I spent time while working at Motion Computing learning about the credit card industry. It was humorous to learn that in the jargon of the credit card companies, those who pay off their monthly charges in full are called "freeloaders." LOL

###

US Federal law changes about 15 years ago enabled retailers to add "convenience" fees, typically 3%, to credit card charges. The merchant (as card companies call them) pays about 3% when a consumer uses a card, so they are trying to level up to cash payers.

The same law caps debit card fees at about $0.05 and 0.21% of the charge. If you enter your PIN, it IS a debit charge. The merchant may or may not choose to charge 3%, but if some offer to accept a debit card without tacking on 3%, it may make sense to pay with debit, although I'd be leery unless it is a well known establishment where you know the owners.

Also, debit cards include the logo of a credit card network. In most cases when using one of these debit cards, the payment is often routed through the credit card network, not the capped-fee debit network, but the buyer still does not get the credit card protections that Ben's post discusses. The key thing to remember here is that if you as the consumer are using a debit card with a MasterCard or Visa logo, you are still NOT protected like a credit card user would be.